When planning to buy a new home, you may face challenges. These include high rent, location, exterior inspection, and property value. Whether you want to buy your dream home or upgrade your standard, you must understand the variations in housing.

Why?

Every year, the real estate landscape changes, and so do the housing options. In this blog, we’ll shed some light on the pros and cons of condos and apartments and what will suit you the best.

What is Condo?

A condo refers to a particular type of housing where you have an individual living unit. It can be in a big residential complex. The person who owns the condo has their title to that specific unit. They also share ownership of areas like hallways, lifts, and facilities with others. Condo owners need to pay monthly fees to maintain the shared spaces. This happens through a homeowners’ association (HOA).

What is an Apartment?

An apartment is a unit you rent in a multifamily residential building. It is of one entity or company in charge of property management. In an apartment, people living there are not owners. They pay monthly rent to the landlord or manager of the property. It is a nice choice for people who want to have an easy or short-term place of residence.

What you Really Need to Know about your First Apartment?

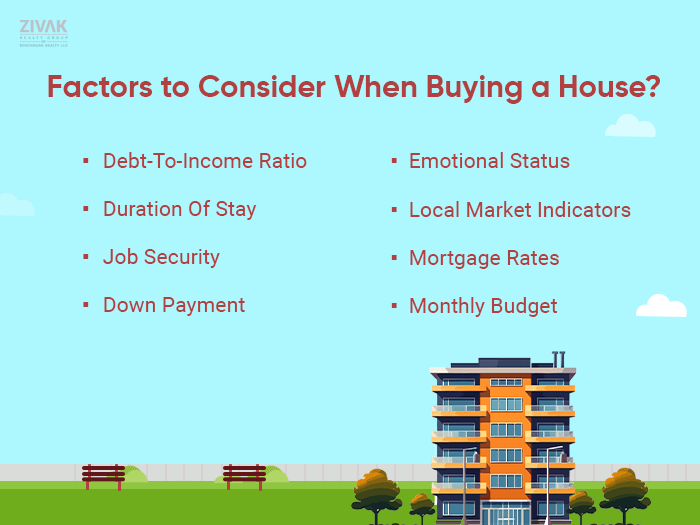

Get InformedWhat are the Common Factors that you Should Consider when Buying a House?

1. Debt-To-Income Ratio

A mortgage lender checks the debt-to-income ratio to see if you have enough money every month. It is inevitable to pay back your loans and manage other financial responsibilities.

Remember this: it’s not only about what lenders tell you; more importantly how much do you know you can afford? No one knows your finances better than you. So, always purchase condos and apartments where its cost will not stretch or overburden your income.

2. Duration Of Stay

The time you predict staying in the home is a frequently ignored aspect. This is critical to analyze when purchasing. Based on your duration of stay, is it more financially sensible to buy instead of rent? There is no straightforward response to this general query. Every market is unique, so the below factors will help you decide if purchasing is the correct choice.

3. Job Security

More jobs and higher wages make people feel better about their lives. When the economy grows, it is easier for people to get work and earn more money. This can improve employer sentiment. But even if you have a job, it’s possible that concerns about job security could still be on your mind.

How can this not happen? We are in a period of recovery, coming out from one of the most severe economic drops in American history. There is much fear and worry around. Even so, when you decide to buy condos and apartments, it’s not ideal for thoughts about job safety to enter your mind.

4. Down Payment

Making a down payment for buying something is a hurdle for people who want to buy. They usually struggle with the upfront cost. Millennials, in particular, have difficulty saving large sums of money. The reason behind this is that the millennial generation has loans. The underwritings have increased complexity. The rents have made savings inadequate for down payments.

How Much Down Payment Do You Need to Buy a House in Tennessee?

Check It Out5. Emotional Status

Even if it seems obvious, the emotional state of a buyer is vital in this process. But, everyone does not need to have a home. Purchasing property requires serious commitment. Many people may not be prepared there at present.

Some might still desire to travel around the globe or search for their ideal job. And maybe having a house includes extra duties that not everyone wishes to handle.

6. Local Market Indicators

You cannot control the local market. It is very frustrating, but you may not have any options at all. Perhaps the market you are interested in does not have homes within your price range or a suitable location.

Additionally, certain market values influence whether owning is feasible or not. Although it may become less costly to buy if compared to renting in certain markets. There exist other options where renting still makes sense.

7. Mortgage Rates

Most individuals anticipate a boost in mortgage and interest rates this year. The Federal Reserve plans to make its monetary policy less and reduce its balance sheet. However, this forecast has been circling the real estate sector for some time now. It’s hard to know if and when there will be an increase in mortgage rates.

8. Monthly Budget

Purchasing a house can bring forth financial expenses that are not initially seen. It is crucial to consider the home’s price when you purchase it. But also include other monthly costs related to owning this property. When you are buying a home in Nashville, it becomes very important to budget for the basic monthly costs.

However, you also need to make sure there is room within your budget for other monthly costs. This may include property taxes, home insurance, utilities, and routine maintenance, among others.

What is the Difference Between Condos and Apartments?

Ownership: The major difference is about who owns it. Condominiums are owned by people, and they rent them out privately.

On the other hand, apartments are owned by a company that handles all rental and unit management. It makes things more typical for an apartment complex.

Maintenance: Every owner has to handle the maintenance of their particular unit. They’re solely responsible for the same.

In apartments, the owner of the property will take care of the maintenance thoroughly. Just give them a call, and it will be done.

Amenities: Condo owners can design their units as they want. Be it kitchen worktops or flooring, you can do it all.

Here, renters don’t have the liberty to redesign anything without looping in the owner.

Rent: When buying a condo the fees vary on various factors like location, the space, and the amenities.

Even in apartments, rent varies. It involves costs like security deposit, first and last month rent, and more.

What’s the Best?

In a nutshell, buying a condo or apartment depends on various aspects. But, mainly, you need to understand your requirements and budget. However, you can hire the best real estate agent in Nashville to make the right choice. These firms have years of experience and can make your process seamless.

Are You Looking For Expert Guidance

from real estate experts for a seamless home-buying experience?

Contact Us